U.S. HVAC Industry Overview

The US HVAC is a highly fragmented market with more than 105,000 companies operating in the region. The ecosystem comprised of HVAC manufacturers, third-party channel distributors, and certified contractors, and end-users. Moreover, the US HVAC industry is highly regulated, where contractors are highly approved by the North American Technician Excellence (NATE) organization that independently certifies technicians in the heating and cooling industry. Additionally, the standards have been pre-defined for the various states by the local authorities. For instance, in the northern states of the US, the furnaces are required to 90% efficiency ratings, whereas in southern states required only 80% of the efficiency rating. This suggests the US HVAC is highly regulated which defines the trends of the market.

Integrating Smart Technology leading to market growth in the US

According to DataHorizzon Research, most of the US companies are incorporating automation to simplify their sales process and service delivery, enabling them to reduce their customer acquisition costs to a greater extent. The adoption of smart apps is increasingly facilitated by the building owners to operate and control lighting, ventilation, and other application through a single point of contact. Furthermore, On the supply side, HVAC contractors are significantly implementing sophisticated software tools that enable them to have constant customer engagement. Integrating smart sensors, big data, and analytical solutions is anticipated to increase the growth prospect for highly efficient HVAC systems to be installed in the future.

Numbers Game in the US HVAC industry

According to DataHorizzon Research Analysis, the US HVAC market accounted for more than USD 60 billion in 2019 and is expected to have moderate growth during the forecast period. Additionally, according to the US Bureau of Labor, approximately 530,000 employees are engaged in the HVAC industry in the country, out of which California is the leading city with more than 187,000 employees, followed by New York and Texas with 69,400 and 67,300 respectively. Furthermore, by distribution channel, Watsco emerged as one of the HVAC distribution leaders that achieved the highest number of Sales followed by Ferguson Enterprises, Sigler Wholesale Distributors, and Johnstone Supply Inc. By residential sectors, the Carrier Corporation attained the first rank in 2019 in terms of revenue with 17% market share.

Impact of COVID-19 on US HVAC Industry

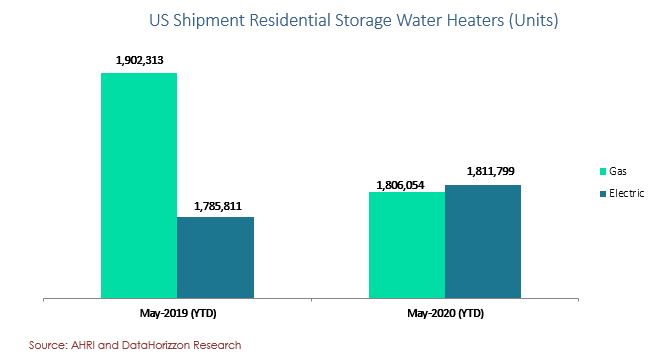

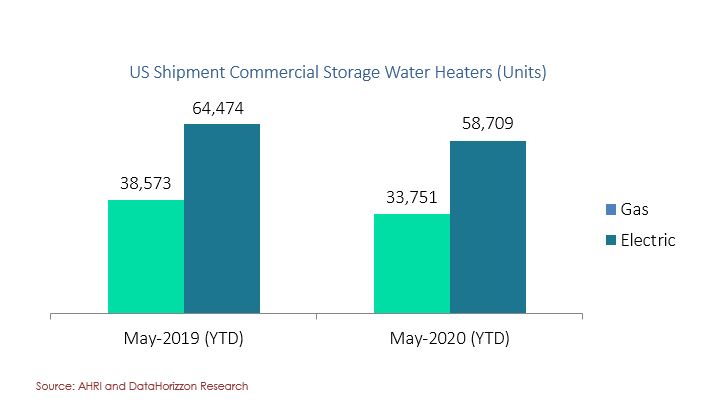

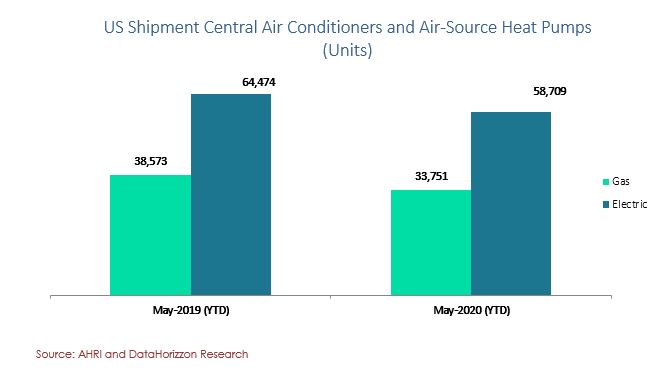

The COVID-19 has a mixed impact on the US HVAC market and witnessed a significant decrease in residential and commercial storage water heater, warm air furnaces, and central air conditioners and air-source heat pumps. The market witnessed approximately 2% decrease in residential storage water heaters from 3,688.1 thousand units till May 2019 to 3,617 thousand units in till in May 2020. Additionally, the commercial storage water heaters witnessed a 10.3% decrease until May 2020. In May 2019, the commercial storage water accounted for 103,047 units, which were decreased to 92460 units. Whereas Central Air Conditioners and Air-Source Heat Pumps witnessed a decline of 6.8% in May 2020 as compared with May 2019. The shipment accounted for 3,609.7 thousand units in 2019 that decreased to 3,362.8 thousand units in May 2020.

The decrease in shipment signifies that the market is highly affected mainly because of the disruption supply chain. However, industry experts believe, the COVID could offer a combination of challenges and opportunities for the HVAC stakeholders and could evolve innovative trends in the market.

With shelter in place and social distancing have been extremely followed across the country, as a result, the HVAC business experienced temporarily shut down, and encouraged the employees to work and operate remotely. On the contrary, in the US, the HVAC has been considered under essential business, which allows the HVAC service providers to induce recruits and training services.

Some of the companies are offering virtual maintenance services to their customers. For instance, NETR Inc, and Heating and Air, are providing virtual maintenance calls, The adoption of video conferencing and collaboration tools such as Skype, and Facetime allows customers to resolves their service calls. This also encourages customers to solves their problems face-to-face with trained technicians and maintain social distancing norms.

Furthermore, during pandemic HVAC industry is witnessing an increasing number of service calls from the residential sector. This is attributed to an increase in work from home norms leading to overwork of the HVAC equipment that enables pressure on compressor resulting in system failure. Also, some of the companies informed about the air quality they breathe at home, which leads to an increase in demand for new air filters and UV air purifying products. Moreover, the commercial segment demand for service calls was mainly from the essential services sector namely healthcare facility center and grocery store.

Considering the layoffs due pandemic crisis and adoption of innovative tools for training services, experts believe, the employment growth in the US HVAC market is presumed to witness a double-digit for the next ten years. Additionally, highly financially stable companies are utilizing this time to recruit new talent to their team that enables them to provide high-end service to commercial and residential sectors.